ADA Price Prediction: Technicals and Fundamentals Align for Potential $1 Breakout

#ADA

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

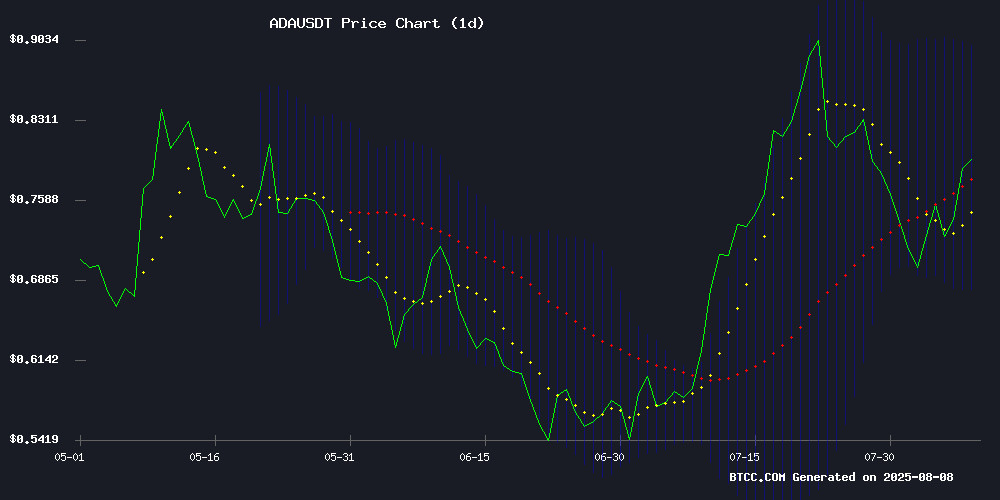

According to BTCC financial analyst James, ADA is currently trading at $0.7949, slightly above its 20-day moving average of $0.78807. The MACD indicator shows bullish momentum with a positive histogram (0.034026), while Bollinger Bands suggest potential volatility with the price hovering NEAR the middle band. 'The technical setup indicates accumulation phase with upside potential toward $0.898 upper band,' James notes.

Market Sentiment Turns Bullish for ADA

BTCC's James highlights growing optimism: 'The Plomin hard fork and ETF speculation are creating perfect conditions for ADA's breakout. While current price action lags fundamentals, technicals and seasonality suggest Q4 could see a MOVE toward $1.30.' News headlines reflect this positive sentiment with multiple price prediction articles emerging.

Factors Influencing ADA's Price

Cardano Price Prediction 2025: ADA Surges on Plomin Hard Fork and ETF Speculation

Cardano (ADA) has gained bullish momentum following the Plomin Hard Fork, which introduced full decentralized governance. The upgrade has revitalized Cardano's ecosystem, attracting institutional interest, including a significant allocation from Grayscale Investments.

ADA's price surged 5.76% in 24 hours, trading at $0.769 with a $1.5 billion trading volume. EMURGO's Ctrl Wallet deal further enhances Cardano's interoperability, connecting it with over 2,300 blockchains.

Market optimism for ADA in 2025 continues to grow, driven by July's strong performance and increasing institutional backing. The Plomin Hard Fork has been a historic milestone, reinforcing Cardano's commitment to community governance and decentralized decision-making.

Cardano (ADA) Price Prediction: Breakout Potential Toward $1.30

Cardano's ADA exhibits bullish momentum, gaining 4.35% in 24 hours despite a 3.68% weekly dip. Trading at $0.7552, it hovers above the critical 0.618 Fibonacci retracement level at $0.7548—a technical threshold often signaling trend reversals. Analysts note a breakout above $0.84 could propel ADA toward $1.05, with $1.30 as the next target if bullish sentiment holds.

Market cap stands at $26.36 billion, reinforcing ADA's position among top cryptocurrencies. Failure to breach resistance may trigger a retreat to $0.68 or lower. The asset's performance near key levels suggests a potential inflection point, drawing scrutiny from traders anticipating volatility.

Cardano Metrics Signal Quiet Accumulation Amid Price Lag

Cardano's market metrics reveal discreet accumulation activity despite its price underperformance relative to peers. The blockchain's on-chain data suggests strategic positioning by investors anticipating future growth, particularly as development milestones approach.

The Ethereum co-founder's project continues differentiating itself through peer-reviewed protocols and proof-of-stake infrastructure. With DeFi capabilities in development, ADA's methodical approach contrasts sharply with volatile meme coin sectors while maintaining top-ten market capitalization.

Cardano Price Prediction: ADA Eyes Q4 Breakout as Technicals and Seasonality Align

Cardano is showing signs of a potential Q4 rally, backed by historical seasonality and bullish technical indicators. The cryptocurrency has consistently posted gains in the final quarter of the year, with 2023 and 2024 following this pattern. Analysts suggest 2025 could mirror this trend.

Technical tools like MACD, RSI, and Stochastic Oscillator all point to a buy signal for ADA. Weekly and monthly charts reinforce this optimism, with 12 of 13 moving averages supporting upward momentum. The alignment of these factors suggests growing strength as Q4 approaches.

Will ADA Price Hit 1?

Based on current technicals and market sentiment, ADA shows strong potential to reach $1 in Q4 2025. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.7949 | 26% upside needed |

| 20-day MA | $0.78807 | Bullish support |

| MACD | 0.034026 | Growing momentum |

| Bollinger Upper | $0.8984 | First target |

James concludes: 'The combination of technical accumulation, upcoming hard fork, and ETF speculation creates favorable conditions for ADA to test $1 levels later this year.'

- Technical indicators show ADA in accumulation phase with bullish momentum

- Plomin hard fork and ETF speculation creating fundamental catalysts

- Q4 seasonality and technical alignment suggest $1 target achievable